We often assume billionaires are immune to financial failure. After all, with fortunes running into billions, how could they possibly go broke? But the reality is far more dramatic. Financial mismanagement, legal troubles, risky investments, and market crashes have taken down even the richest. Today, we take a look at the top 10 billionaires who ended up bankrupt, offering valuable lessons in wealth, risk, and resilience.

At one point, Eike Batista was Brazil’s richest man with a net worth of over $30 billion. His company, OGX, was heralded as the future of Brazil’s oil industry. However, it all came crashing down in 2013 when OGX failed to meet production targets. Investor confidence plummeted, and Batista’s empire collapsed.

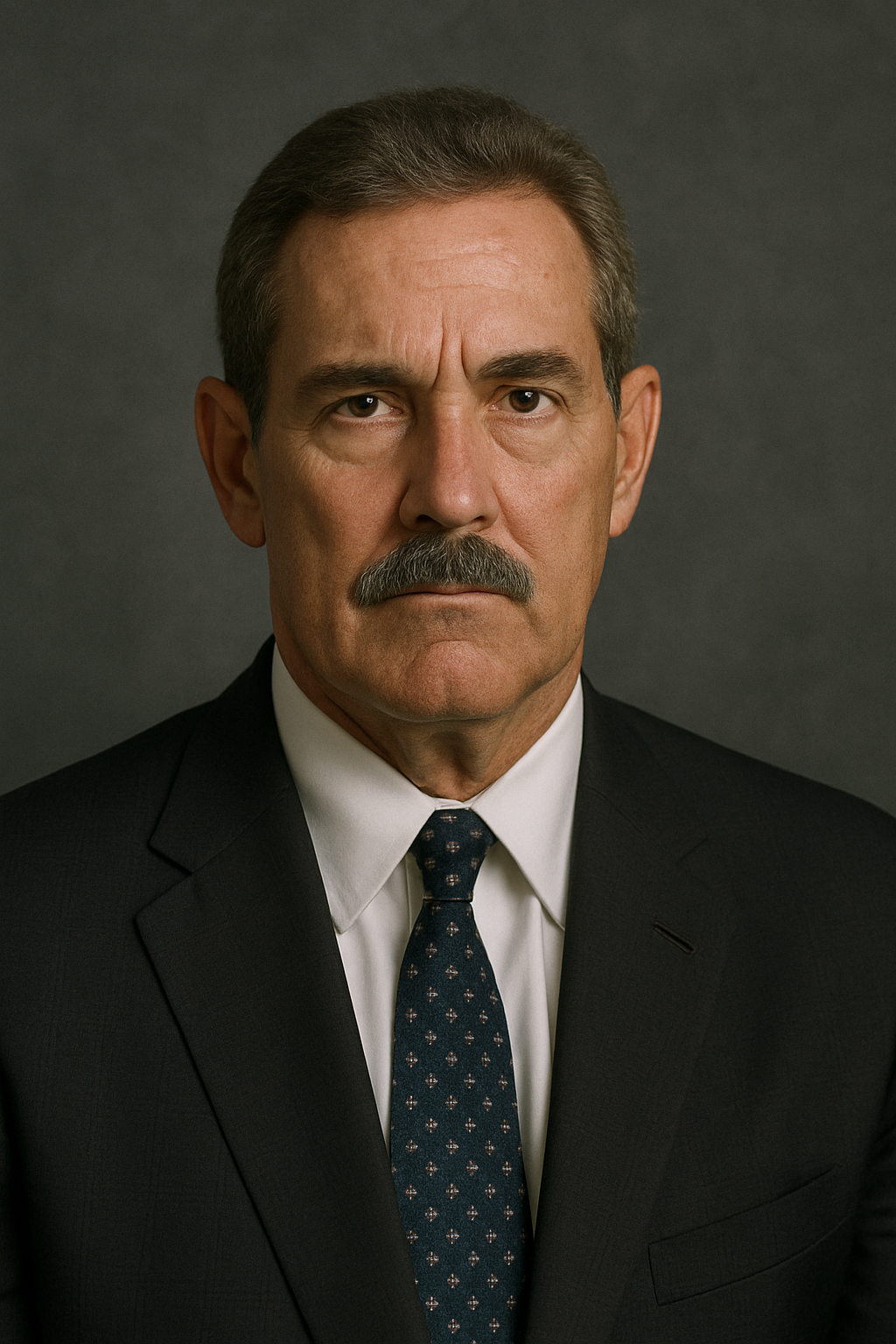

Allen Stanford, a once-celebrated financier, was convicted of running a $7 billion Ponzi scheme through Stanford Financial Group. His lavish lifestyle, which included yachts, private jets, and cricket sponsorships, came at the cost of thousands of investors’ life savings. Today, Stanford is serving a 110-year prison sentence, and all his wealth has vanished.

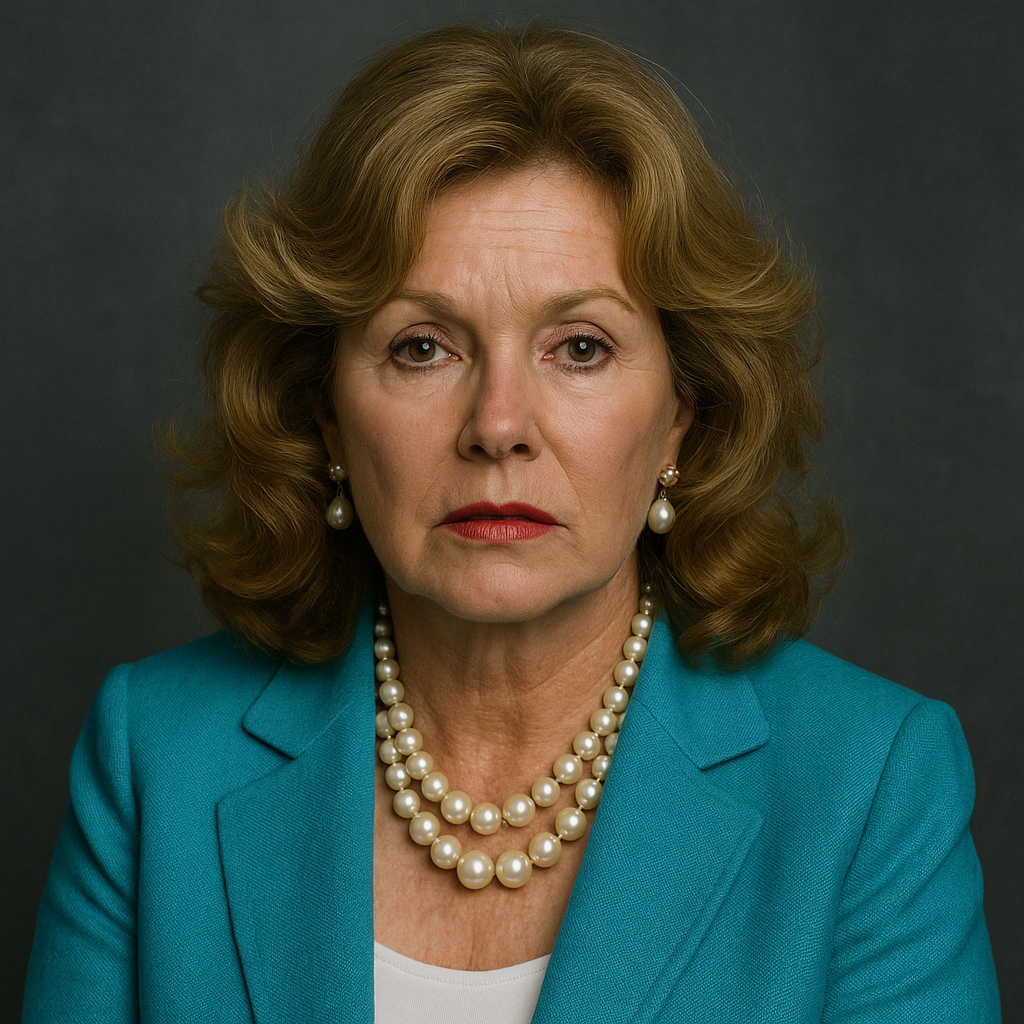

Once married to media mogul John Kluge, Patricia inherited a vast fortune and estate. However, her wine business venture and luxury lifestyle drained her wealth. In the 2008 financial crisis, she lost everything — including her 24,000-square-foot mansion in Virginia. Even Donald Trump later bought parts of her estate at auction.

Sean Quinn built a fortune through Quinn Group in insurance, manufacturing, and real estate. In a bold move, he heavily invested in Anglo Irish Bank — right before the 2008 crash. The bank’s collapse wiped out his assets, and he eventually filed for bankruptcy.

An Icelandic billionaire and major stakeholder in Landsbanki, Guðmundsson was once worth over $1 billion. However, Iceland's banking collapse during the 2008 global recession dragged him into insolvency. He was declared bankrupt in 2009, the biggest individual bankruptcy Iceland has seen.

While not technically a billionaire anymore, Elizabeth Holmes once topped Forbes’ list of youngest self-made women billionaires thanks to her company Theranos. However, her biotech empire was built on fraudulent claims about revolutionary blood-testing technology. After investigations, lawsuits, and a high-profile trial, Holmes lost her fortune and now faces jail time.

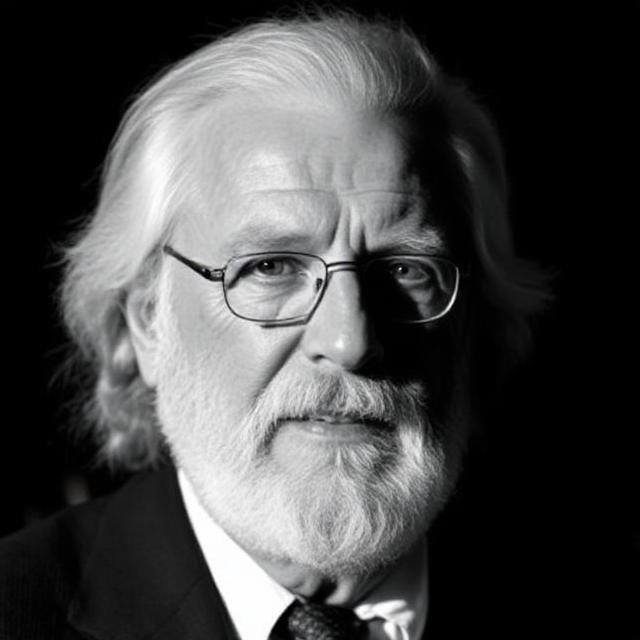

Adolf Merckle, a German industrialist, had an empire spanning cement, chemicals, and pharmaceuticals. He suffered massive losses after betting against Volkswagen’s stock during its 2008 short squeeze. The losses pushed him into financial distress, and tragically, he took his own life in 2009.

As co-founder of Chesapeake Energy, Aubrey McClendon rode the wave of the U.S. fracking boom. He was a billionaire in the early 2000s but over-leveraged himself. After being indicted on federal charges related to land-leasing deals, McClendon died in a car crash a day later. By then, his fortune was already wiped out.

Bernie Madoff, once a highly respected financier and former NASDAQ chairman, ran the largest Ponzi scheme in history, worth around $65 billion. For years, he faked returns, luring celebrities, institutions, and even charities. He was arrested in 2008 and sentenced to 150 years in prison, dying behind bars in 2021.

Known as the "King of Good Times," Vijay Mallya built an empire in alcohol (Kingfisher) and aviation. His Kingfisher Airlines failed due to mismanagement and heavy debt. Mallya fled India in 2016 and is now wanted for money laundering and loan default of over $1.5 billion. His luxurious lifestyle could not save him from financial ruin.

Be First to Comment